Last Thursday I attended a public lecture at University of Melbourne by prominent commentator on the Japanese economy, Richard Koo. Koo has advisory positions with various central banks and has written books on the Japanese economy and the lessons the rest of the world can learn from its prolonged downturn of the 1990s.

Koo’s main points in this lecture (Lecture notes here) were that fiscal stimulus was important to Japan in the 1990s and much of the world today finds itself in what he calls “balance sheet recession” – a situation in which firms become net savers, reducing debt levels, even at near zero interest rates.

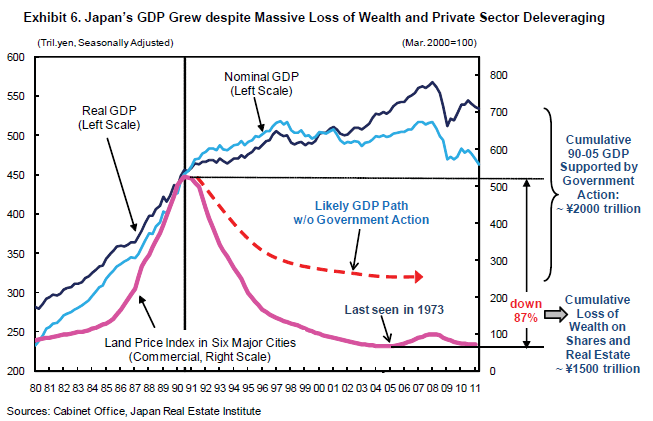

I was interested in what Koo had to say, particularly as I used to live in Japan where I read books by another prominent commentator on the Japanese macro economy, Richard Werner. Werner’s ideas are different to say the least. He argues that fiscal stimulus was ineffective in Japan in the 1990s, that it failed to produce any sort of recovery, and that Koo’s claims that the situation would have been worse if there hadn’t been stimulus measures are without empirical basis and are logically flawed – as no recovery came, it’s hard to find causality for something that never happened and it’s impossible to disprove that it would have been worse otherwise. Werner’s books have a fair bit of data on this, while Koo’s exhibit 6 in the lecture showed a sourceless “likely GDP path w/o Government Action” dotted line:

Werner’s other main difference with Koo is his idea that the low levels of borrowing witnessed in Japan in the 1990s were caused by restrictive credit policies by the Bank of Japan, rather than Japanese borrowers being unwilling to borrow. His book Princes of the Yen provides evidence for this idea over a hundred or so pages.

So, intrigued by what Koo’s response would be to Werner’s ideas, I went along. When no obvious answer emerged during the lecture, I asked:

RC: What is your response to Richard Werner’s criticisms of your ideas, specifically that:

- fiscal policy was ineffective in creating a recovery and to claim “it would have been worse without it” is essentially unfalsifiable, and;

- that what you call balance sheet recession was in fact caused by restrictive credit policies of the Bank of Japan?

And the answer:

RK: The short answer is he doesn’t know what he is talking about. Next question…..

THAT WAS IT! Thinking that perhaps he would have given an answer but was pressed for time, I approached him after the lecture. I thanked him for an interesting talk and re asked my question, but got nothing more than a restatement that Werner was crazy and could I imagine what would have happened if the Japanese government hadn’t spent gazillions of yen.

I don’t have any strong opinions on who is right and who is wrong here, but I do find it pretty disturbing that someone who is meant to be one of the leaders of the field can’t or won’t answer a modestly informed question. Especially when he would have you believe he is a total economic rock star.

Having trammed it across town on a rainy, cold night to sit there for 90min listening to a few interesting ideas mixed with liberal amounts of grandiose name-dropping, I felt like saying, as we do in Brazil, “Vai tomar no Koo!”